The New Digital Bank Transfer: How E-Money Vouchers Are Redefining Secure Online Spending

In a landscape where speed, innovation, and security are driving forces, digital transactions demand more than just convenience – they require next-level trust and agility. The era of relying on slow, traditional bank transfers is quickly coming to an end. Enter e-money vouchers: the fintech solution transforming how modern users and organizations manage online payments.

Why Bank Transfers Are Quickly Becoming Obsolete

We’re living in a world where milliseconds matter – whether you’re capturing market opportunities, managing business expenses, or powering up your favorite digital service. Bank transfers, with their multi-step verifications, processing times, and potential for security lapses, simply can’t keep up with the real-time demands of today’s economy.

For individuals and businesses alike, the risk of payment delays or rejected transactions is not just an inconvenience; it’s a potential blocker to growth and operational fluidity.

E-Money Vouchers: Security, Speed, and Control

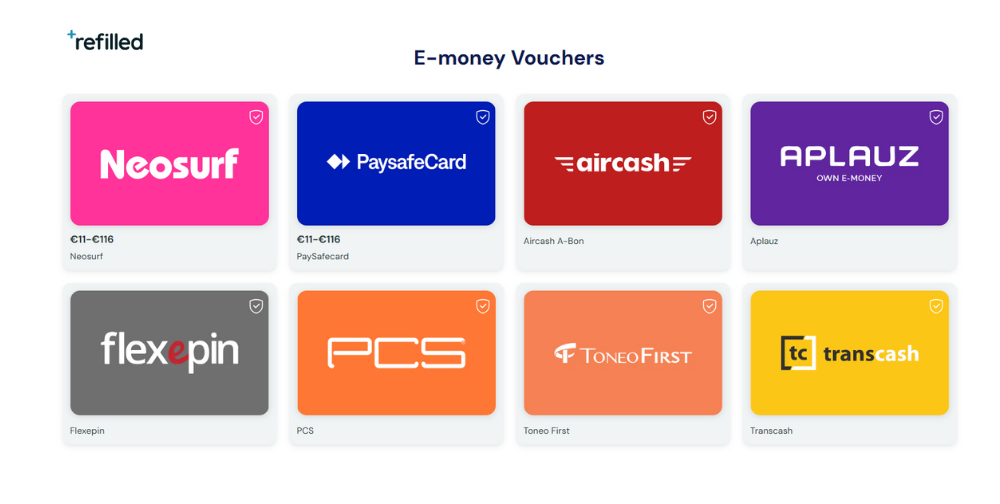

This is where e-money vouchers – like those offered through Refilled.com – step in. These digital instruments deliver instant, encrypted value for online payments across services, subscriptions, and digital storefronts. No need to share sensitive bank or card details repeatedly. Simply purchase a voucher, redeem a secure code, and transact privately and immediately.

The innovation lies in the trifecta of benefits:

- Speed: Top up digital wallets or services in seconds. No waiting for bank protocol.

- Security: Every transaction is protected; your financial data never circulates through third-party platforms.

- Control: E-money vouchers empower users and enterprises to closely monitor spend, reduce fraud risk, and avoid unnecessary exposure of payment details online.

Whether you’re topping up software subscriptions, managing remote team payments, gifting credit, or equipping employees with controlled expense accounts, e-money vouchers give you the flexibility and peace of mind that traditional banking simply can’t.

Why Trust Is Non-Negotiable

In fintech, trust is the true currency. Increasing cyber threats, data breaches, and compliance risks have elevated the importance of choosing only certified, transparent payment solutions. That’s why more users and organizations are seeking out platforms like refilled.com. Here, every voucher is delivered instantly and securely, with transaction integrity and privacy guaranteed.

Being a certified reseller isn’t just a badge – it’s a commitment to rigorous standards, ensuring that each digital code is valid, every payment is transparent, and customer support is always available.

The Future of Digital Payments Is Flexible

As the digital economy accelerates, adaptability is king. E-money vouchers aren’t just a workaround – they’re rapidly becoming the preferred method for businesses, freelancers, digital natives, and parents teaching financial literacy. Want to automate recurring digital payments without risking overexposure? Need to gift, cap spending, or instantly reload digital accounts? It’s simpler, safer, and smarter with e-money vouchers.

The shift away from bank transfers isn’t just a trend – it’s a strategic response to a fast-paced, security-focused world. For seamless, instant, and secure digital payments, refilled.com is the go-to place, powering the next wave of fintech efficiency.